Last week Dr. Lawrence Yun, Chief Economist and Senior V. P. of Research at the National Association of Realtors, paid a visit to Charlottesville to offer his economic and real estate outlook at the Charlottesville Area Association of Realtors (CAAR) General Membership Meeting. He emphasized that the moderate recovery we’re experiencing in rising home sales is a positive thing because it is much more sustainable than the boom in the early 2000s caused by subprime lending. The challenge we face today, he said, is the lack of supply to meet the demand. Specifically, there are too few available houses that meet the needs of first time home buyers. Yet he is hopeful that steady recovery will continue and that there will be the potential for growth going forward.

In order to create a more detailed picture of what is happening, he presented his analysis of the middle class today. The fact that median household income has not fully recovered to match the levels seen in 2000 and 2007, he says, has upset middle class ideas about the American Dream. He then pointed out that a majority of American families are not directly impacted by positive spikes in the economy because only 10% of them have a meaningful ($100K or more) investment in the stock market, which contributes to the overall viewpoint that the economy is not recovering. Then there is the fact that despite making high profits, businesses are not spending as much as they used to. And even though the employment rate is rising and the unemployment rate appears to be falling, he pointed out that what these statistics fail to show is the unemployed person who is not actively searching for work, as this is a requirement to be included in the unemployment rate. Specifically in Charlottesville, he said, there are 20,000 more people with jobs in the area than there were in 2000, which has contributed to the high housing demand.

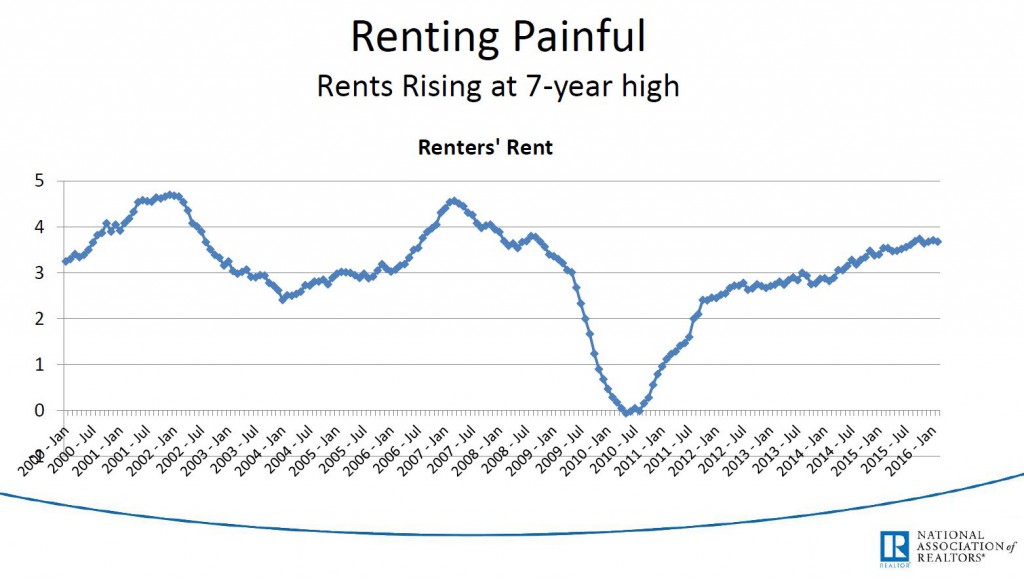

In addition, rent is at a 7-year high, he said, and will be the driver of inflation in the future. Rising rents encourage home ownership, which offers the benefit of a stable mortgage payment. And a high inflation rate will mean higher mortgage interest rates. But currently the rate of homeownership is at a 50-year low. Younger households are less likely to own, a fact explained by the large wealth gap between young adults (defined by those under 35) and retirees. While wealth has grown for retirees since 1983, it has declined for those under 35. Yun sited contributing factors such as the rise of tuition and student loan debt, as well as medical inflation. This is the reason, Yun said, we’re seeing less foot traffic and lockbox openings.

The National Association of Realtors will make a large effort in the next year, he said, to present to the next President of the United States the benefits of home ownership. These include a lower juvenile delinquency rate, better health, self-esteem, and civic engagement. But since all of these benefits can be counteracted by foreclosure, the National Association of Realtors will emphasize the need for sustainable home ownership. The good news in Virginia is that the mortgage delinquency rate is lower than the rest of the country.

In an article published on Forbes online titled “Are We Entering a New Housing Bubble?” Yun argues that we are not heading toward another bubble as we currently lack the inventory for such a thing to happen. He advocates for more home-building in order to meet the current demand and maintain a gradual recovery of the economy.

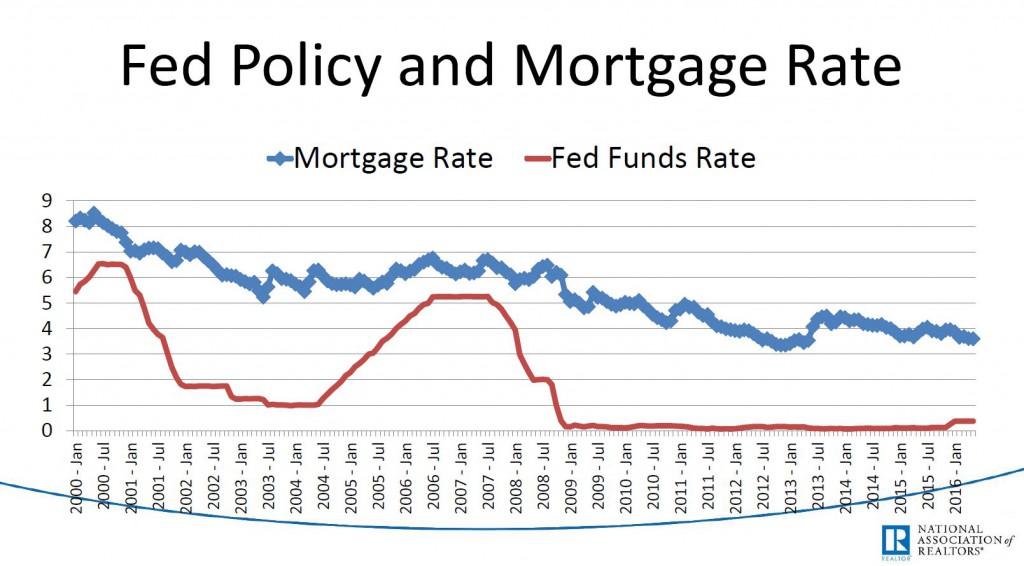

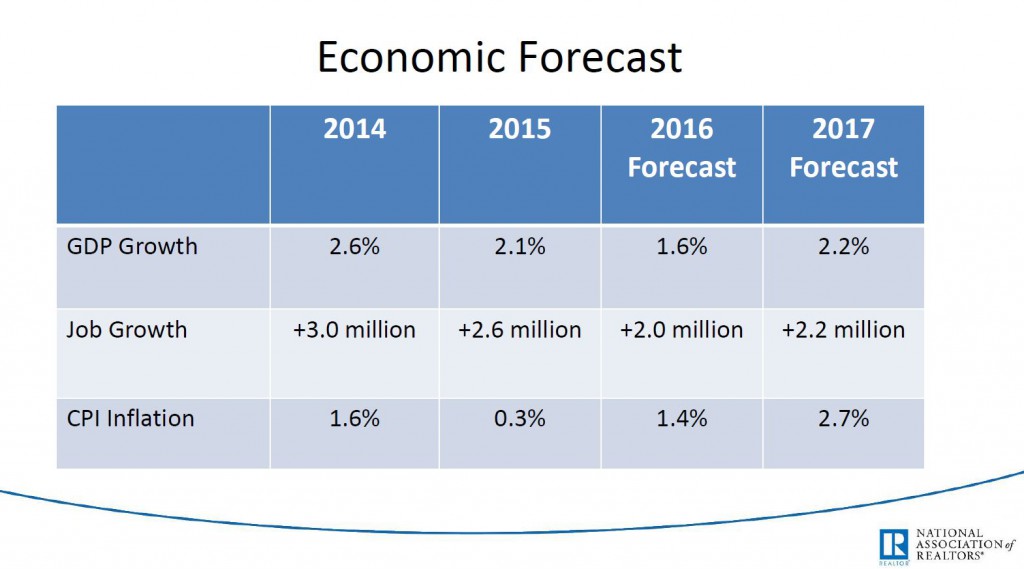

He also pointed out at the CAAR meeting that the Federal Reserve always waits until after an election to raise rates because they don’t want to affect the outcome of the election. But Yun predicts that the mortgage rate will be more affected by inflation in 2017 and 2018, rather than by actions of the Federal Reserve. His economic forecast is that the economy will continue to be subpar, but may be affected by whoever is elected for President of the United States. He predicts that growth of the GDP will be 1.6%.

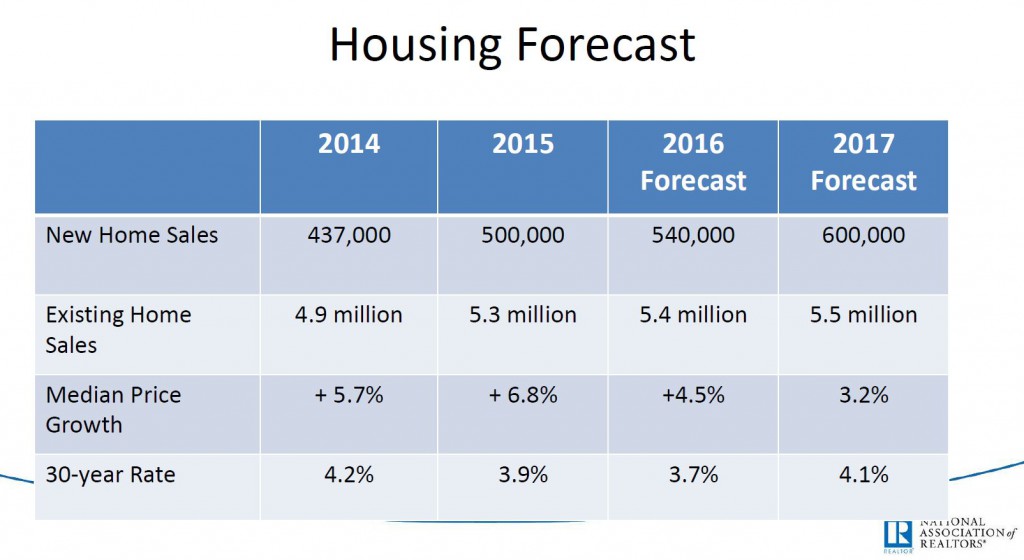

His housing forecast is as follows.